|

|

| |

|

Jennifer,

A new income-driven repayment (IDR) plan that could lower your monthly student loan payment is now available.

The Biden-Harris Administration’s new Saving on a Valuable Education (SAVE) Plan is the most affordable repayment plan ever created. The SAVE Plan replaces the Revised Pay As You Earn (REPAYE) Plan and provides multiple new benefits, including lower monthly payments.

Like all IDR plans, the SAVE Plan calculates monthly payments based on income and family size, rather than loan balance. After a set number of years, your remaining balance is forgiven. This benefit of IDR plans is particularly important because the payment pause is ending, and your payments will resume in October. Student loan interest will resume starting on Sept. 1, 2023. Now is the best time to make sure those payments are affordable.

If you were on the REPAYE Plan, you will automatically receive the benefits of the SAVE Plan without needing to take action.

If you were not enrolled in REPAYE or any other IDR plan and want to take advantage of the benefits of an IDR plan, including the SAVE Plan, don’t wait to apply. The application takes 10 minutes or less.

|

|

|

|

Log in to your Dashboard to review your current repayment plan, which is listed under “My Aid.”

|

|

| |

Benefits Under the SAVE Plan

|

| |

1 |

Lower monthly payments: You might qualify for a monthly payment as low as $0 if you are a single borrower earning $32,800 or less or a family of four earning $67,500 or less. If you’re making more than $32,800 a year, you’ll save at least $1,000 a year compared to other IDR plans.

|

|

| |

2 |

Your loan balance won’t grow as you repay: If your monthly payment is lower than the interest accrued that month, you won’t be charged the difference. You’ll no longer see your total balance grow due to unpaid interest when you pay your monthly payment amount.

|

|

| |

3 |

We can recalculate your monthly payments automatically every year: For most borrowers enrolling in an IDR plan, you will be able to sign up to have your income information recertified automatically each year. You’ll still be notified when your payment amount is changing, but you won’t have to take any action.

|

|

| |

4 |

Increased protection if you lose your job: On IDR plans, you can manually recertify and update your income information early to adjust your monthly payment amount. If you lose your job and don’t have taxable income, you could qualify for a $0 monthly payment.

|

|

|

| |

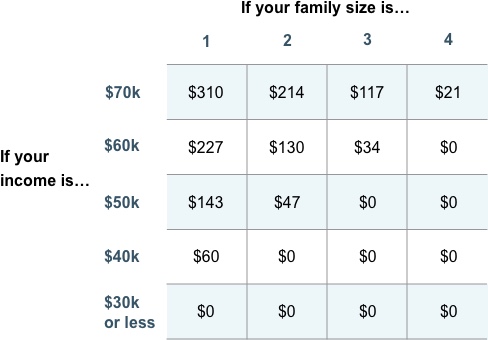

How Much You’ll Pay Each Month Under the SAVE Plan

|

|

Note: Assumes family lives in the contiguous 48 states. Estimates are for illustrative purposes only. Your loan servicer will calculate your monthly payment amount under the new plan.

|

|

|

| |

Frequently Asked Questions

|

| |

• |

What would my payments be on the SAVE Plan?

Use the Loan Simulator to get an estimate of your monthly payments on the SAVE Plan and other repayment plans.

|

|

| |

• |

Where can I find my current repayment plan?

Log in to your Dashboard to review your current repayment plan, which is listed under “My Aid.” If you’re already on an IDR plan and want to switch into SAVE, you can enroll by using the IDR application.

|

|

| |

• |

If I apply for the SAVE Plan in August, will my application be processed before I have to start making payments?

Yes. If you apply for an IDR plan (including the SAVE Plan) in August, your application will likely be processed in time for your first payment due date. Apply as soon as possible.

|

|

|

| |

|

Beware of Scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with the U.S. Department of Education and our loan servicers, and never reveal your personal information or account password to anyone.

Our emails to borrowers come from noreply@studentaid.gov, noreply@debtrelief.studentaid.gov, or ed.gov@public.govdelivery.com. You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov.

Learn how to avoid student aid scams.

|

|

| |

|

Sincerely,

Richard Cordray

Chief Operating Officer

Federal Student Aid

|

|

| |

| How helpful was this email? |

Very

unhelpful |

|

Very

helpful |

|

|

| |

|

|

Sign up for text alerts to stay updated on our grant programs, loan forgiveness programs, repayment plans, and information about your loans.

|

|

|

This email was sent by: Office of Federal Student Aid

U.S. Department of Education

400 Maryland Ave. SW,

Washington, DC, 20002, US

|

| |

|

Please do not reply to this email. Messages sent to this email address are not monitored. If you wish to contact us, please use the StudentAid.gov contact page. For more information about financial aid, visit StudentAid.gov.

|

|